Choose the financial year for which you want your taxes to be calculated. Why not find your dream salary too.

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control

The Income tax calculator is an online tool that helps you calculate your Income Tax liability for the current Financial year FY 2021-22 ie.

Ay 2021 20 tax calculator. The online income tax calculator for FY 2020-21 AY 2021-22 will help you do just that. From 16122014 to 15032015. From 16032015 to 31032015.

Self Employed Tax Calculator 2021-2022 Self employment profits are subject to the same income taxes as those taken from employed people. Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. Other sources Interest Dividend etc Click below to download the Income tax calculator FY 2020-21 in excel free.

You can download the Income Tax Calculator for FY 2020-21 AY 2021-22 from the link below. Both old and new tax regimes require a proper assessment before choosing one. Citizens and HUFs.

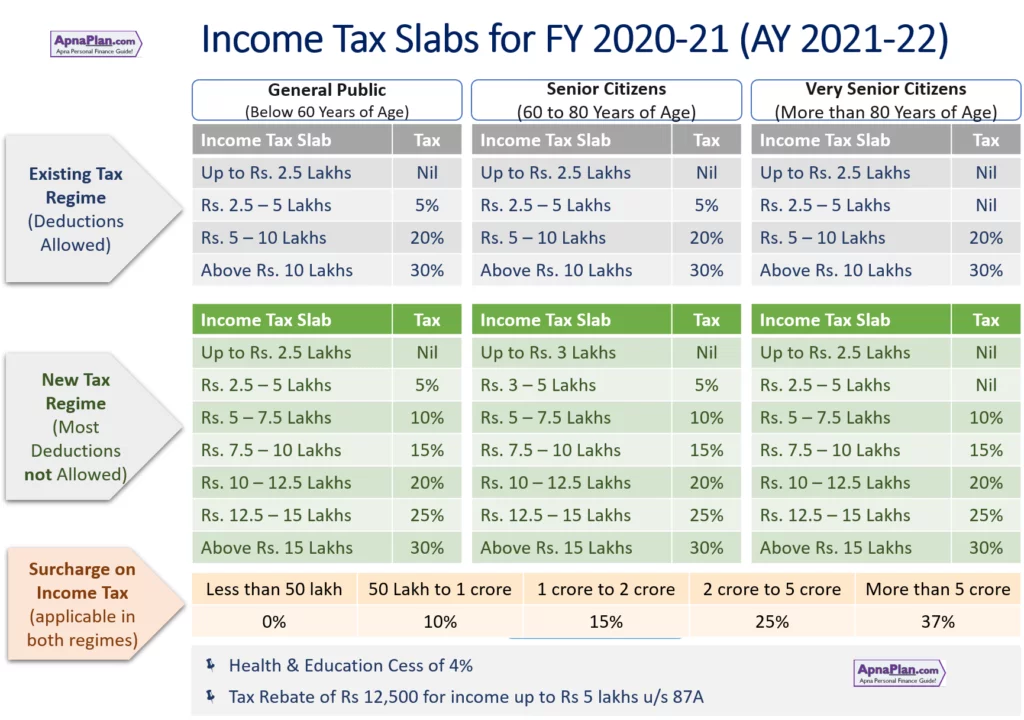

Excel income tax calulator for FY 2020-21 or AY 2021-22. Tax liability in India differs based on the age groups. Following are the steps to use the tax calculator.

Income Tax calculation is one of the complex tasks for the taxpayer. Assessment Year Tax Payer. Tax reduced from 10 to 5 for Income from Rs 250000 Rs 500000 leading to tax saving of up to Rs 12500.

Completed overhauled for 2019-19 tax year our new salary and tax calculator is built to support all your salary and payroll audit needs. Long Term Capital Gains Charged to tax 20 From 01042014 to 15062014. This taxable income calculator is a tool to help you compute your total tax liability in the new and old tax regimes in a quick and straightforward way.

You can use this calculator for calculating your tax liability for FY 2020-21 AY 2021-22. From 16062014 to 15092014. Oct 2021 This handy calculator will show you how much income tax and National Insurance youll pay in the 2022-23 2021-22 and 2020-21 tax years as well as how much of your salary youll take home.

Take the guesswork out of. How to use the Income tax calculator for FY 2021-22 AY 2022-23. AY 2022-23 and the previous Financial Year FY 2020-21 ie.

Download Income Tax Calculator FY 2020-21 Sukanya Samriddhi Account PPF SCSS Calculator Sukanya Samriddhi Account PPF Senior Citizens Savings Scheme are part of small saving scheme sponsored by Government of India. This calculator provides comprehensive coverage for every type of assessee and all heads of income. 1 files 2506 KB.

The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more. This is only a ready reckoner that makes standard assumptions to estimate your tax breakdown. Calculate Income Taxes for FY 2020-21 The Union Budget 2020 has left individuals confused with the choice of the tax regime.

Just enter in your salary and find out how much income tax and National Insurance youll pay. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. In an attempt to offer relief to all the taxpayers.

It calculates Income from Salary. Hourly rates weekly pay and bonuses are also catered for. Click on Go to Next Step 4.

The latest budget information from April 2021 is used to show you exactly what you need to know. Taxmanns Income Tax Calculator helps you compute the taxable income and tax liability under the Income-tax Act. As amended upto Finance Act 2021 Income and Tax Calculator Click here to view relevant Act Rule.

Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. This excel-based Income tax calculator can be used for computing income tax on income from salary pension gifts fixed deposit and bank interest and you will get the result accordingly to your tax regime selection. Income Tax Calculator FY 2017-18 Excel.

To help taxpayers here is a simple excel based Income Tax Calculator for the financial year 2020-21 AY 2021-22. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Income Tax Calculator - Calculate Income Tax Online for FY 2021-22 AY 2021-22 easily at Bajaj Finserv.

Income Tax Calculator for FY 2020-21 AY 2021-22 Excel Download. Interest on Saving Bank Account more than 10000 Income tax calculator. Also compare your Income Tax Liability and the effective tax rate under both the Old and New Income Tax Regime.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. Income Tax Calculator An Income Tax Calculator is a user-friendly online tool which helps you in calculating your income tax based on the taxable income. In Budget 2017 the finance minister has made little changes to this.

Highlights of Changes in FY 2020-21 in Income Tax. With the help of the income tax calculator you can gauge the impact of both the tax structures on your income. The Income Tax Calculator will allow you to calculate your income tax for financial year FY2019-20 AY2020-21 FY2020-21 AY2021-22.

There are many other possible variables for a definitive source check your tax code and speak to the tax office. Select your age accordingly. Read a full breakdown of the tax you pay.

Use the Advance Tax Calculator to calculate your advance tax liability for the FY 2021-22 and AY 2021-22. This calculator assumes youre employed as self-employed national insurance rates are. The calculator is made using simple excel formulas and functions.

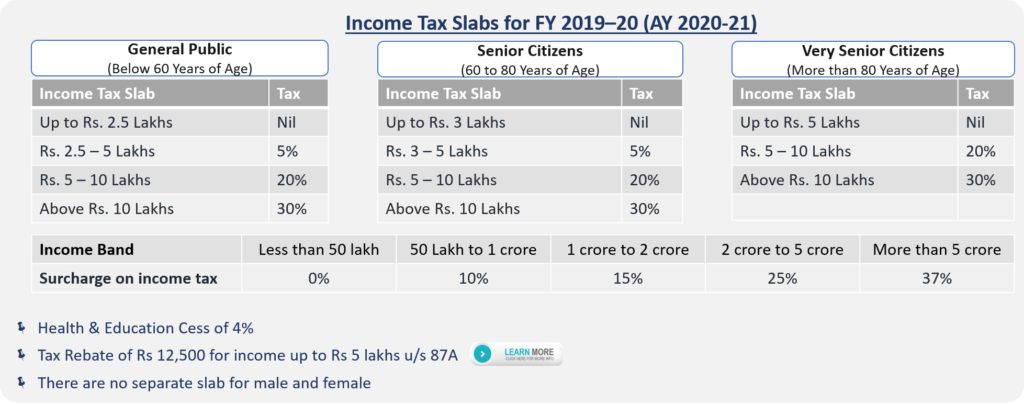

Just change the field value and you can calculate the tax amount for FY 20-21 Existing and New both and get the difference as the tax rate slabs are different for both financial years. Gross Income and Taxable Income after taking into account income from all sources and. Income Tax Calculator AY 2021-22 AY 2022-23 What calculations are made by this Income Tax Calculator.

The key difference is in two areas National Insurance Contributions and the ability to deduct expenses. CALCULATE TAXES FOR FY20 FY21 With exemption. You can calculate tax online for the FY 2019-20 AY 2020-21 FY 2020-21 AY 2021-22 using our income tax calculator which is updated as per the Union Budget FY 2020-21 Income Tax Calculator.

Learn how income tax is calculated using an online income tax calculator. From the middle-class taxpayers the choice is yours. Online Income Tax Calculator.

The Income Tax Calculator FY 2020-21 AY 2021-22 is in Excel and is available Free for download. We highlight the changes and give you the new tax calculator for FY 2017-18 AY 2018-19. This comprehensive Income tax Calculator carries out following calculations as per New and Existing Tax Regimes for Resident Individuals Sr.

From 16092014 to 15122014.

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

No comments