Individuals and HUFs can opt for the Existing Tax Regime or the New Tax Regime with lower rate of taxation us 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D80TTB HRA available in the Existing Tax. This section was introduced to generate more employment and to encourage people.

Download Automated Income Tax Preparation Excel Based Software All In One For Govt Non Govt Employees For F Y 2020 21 With Old New Tax Regime As Per Budget 2020 Tds Tax Indian

Total taxable income.

Computation of salary income for ay 2021 20. From the middle-class taxpayers the choice is yours. Suppose you earn Rs. If you receive HRA and live on rent you can claim exemption on HRA.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Relief under section 89 when the employee gets a salary in the form of arrears or advance. Download offline utilities related to Income tax returnsforms DSC Management Software and.

Other files by the user. Finally tax payable amount. Section 44AB Applicability for Partnership Firm AY 2020-21 Some FAQ in relation to remuneration paid to partners How do you calculate remuneration to partner with an example.

2 education cess 1 higher education cess and 1 health cess. Income from Salary Pension b. 1000000 30 30 Senior Citizen who is 60 years or more at any time during the previous year Net Income Range Rate of Income-tax.

When the last date of income tax return e-filing arrives nearest then we think how to calculate income tax. Nil 25 to 5 Lakhs. 250000 - - Rs.

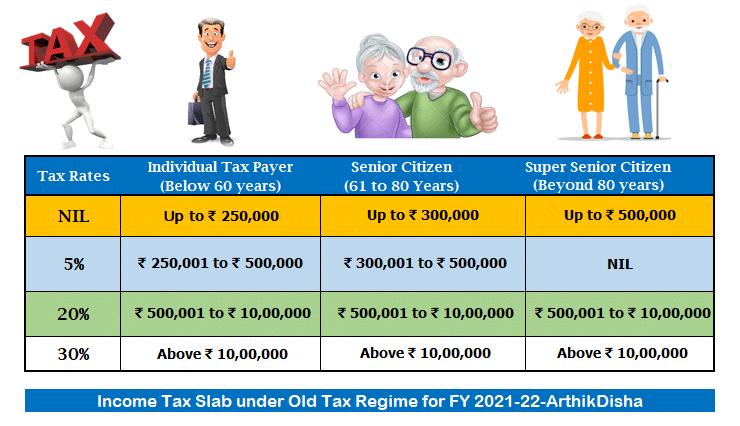

It calculates the tax on Income from Salary. Income from salary is the sum of Basic salary HRA Special Allowance Transport Allowance any other allowance. Old Regime Income Tax slabs for FY 2020-21 AY 2021-22 General public less than 60 years of Age.

90000- as agricultural income for the assessment year 2018-19 or 2019-20. No special exemption is. Utility 101 MB Date of Utility release 20-Dec-2021.

Excel based Income Tax Calculator for FY 2020-21AY 2021-22. 1000000 20 20 Above Rs. Income Tax on Seafarer for FY 2020-21.

Some components of your salary are exempt from tax such as telephone bills reimbursement leave travel allowance. Income Tax Computation AY 2020-21. An Income Tax Calculator is a useful tool which helps the individuals or assesses to known the exact amount of.

In case Section 115BAC is opted the computation of income will be as per the provisions of Section 115BAC and New Tax Rates are applicable. From Assessment Year 2021-22 Individuals and HUFs including Resident Individuals below 60 years of age Senior Citizens and Very Senior Citizens will have option to opt for Section 115BAC. 5 5 to 10 Lakhs.

On the income earned during FY. Separate sheet for each Source of Income. Income from Interest Other Sources.

The calculator is made using simple excel formulas and functions. Excel Tax calculator ready To help taxpayers here is a simple excel based Income Tax Calculator for the financial year 202021 AY 2021-22. GConnect Income Tax Calculator 2020-21 AY 2021-22 The New Tax Regime introduced in the Budget this year FY 2020-21 under Section 115 BAC of Income Tax Act is a tax model with reduced Income Tax Rate and less exemptions.

Calculate Taxable Income Tax etc for Old Regime. Common Offline Utility ITR 5 to ITR 7 For ITR 5 ITR 6 and ITR 7. Meaning conditions tax benefit understanding form 10DA etc for FY 2020-21 AY 2021-22 FY 2019-20 AY 2020-21 Problem of unemployment is not a small problem for any country.

Changes in income tax rules for ay 2020-21. The salary received by a resident seafarer will be taxable as per the laws of the Income-tax department. Budget 2020 bring two tax regimes somehow benefit certain income taxpayers and drag additional tax from certain taxpayers.

Income Tax computation of income tax format in excel for ay 2020-21 download Download Form 16 in Excel Format Latest Ay 2021-22 with Auto Calculations Form 16 Download 2020-21 Excel Form 16 Excel Format for Ay 2021-22 Fy 2020-21 Free Download form 16 in excel format for ay 2020-21 free download form 16 in excel format for ay 2021-22. ITR 2 ITR 3 and ITR 4 for the AY 2021-22. You can use this calculator for calculating your tax liability for FY 2020-21 AY 2021-22.

The calculator is made using simple excel formulas and functions. Maximum remuneration allowable as per section 40b of Income Tax Act 3 Lakh90 6 Lakh60 63 Lakh. This is a big issue to determine taxable income.

Income Tax Calculator is a simply just a tool that calculates reliable income tax for the Assessment Year 2021-22 ie. On 20 July 2020. Deduction For Employment of New Employees.

Book Profit of a partnership firm is Rs. Download Income Tax Calculator in Excel for FY 2020-21 AY 2021-22 Comparison Old and New Regime. Utility for MAC 140 MB Date of MAC Utility release 20-Dec-2021.

500000 5 5 Rs. Net Income Range Rate of Income-tax Assessment Year 2022-23 Assessment Year 2021-22 Up to Rs. Tax on total income.

Up to 25 lakhs. Learn how income tax is calculated using an online income tax calculator. Income Tax calculation is one of the complex tasks for the taxpayer.

Senior Citizen 60-80 years of Age Very Senior Citizen more than 80 Years of Age. 400000- as salary income and Rs. Income from House Property.

Up to 5 lakhs. Presently Taxpayers who are willing to opt for New Tax Regime are required to intimate Pay Drawing Authority in prior. The computation shall be as follows.

The Union Budget 2020 has introduced a new tax regime to assess how much you need to pay as income tax from salary. You can input Capital Gain on Shares Dividend Income TDS deducted by others etc. Interest from Savings Bank Account FD Interest etc c.

Income tax calculation for the Salaried. The taxability of salary received by a seafarer is based on the residential status of the seafarer. Tax Slabs for AY 2021-22.

A rebate under section 87A has been increased to 12500 Rs from 2500 Rs. Income Tax Calculator. Up to 3 lakhs.

To help taxpayers here is a simple excel based Income Tax Calculator for the financial year 2020-21 AY 2021-22. Income Tax Calculator - Calculate Income Tax Online for FY 2021-22 AY 2021-22 easily at Bajaj Finserv. FY 2021 - 22 AY 2022 - 23.

Income from Other sources Interest Dividend etc Click below to download the. EXCEL BASED COMPUTATION CHART xlsx. Computation Of Income Tax Format In Excel For Ay 2019-20 Free Download The Income Tax Calculator FY 202-22 AY 2020-21 is in Excel and is available Free for download.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. This excel-based Income tax calculator can be used for computing income tax on income from salary pension gifts. 5 3 to 5 Lakhs.

The IndiaFirst Life income tax calculator allows you to understand the exact tax structure how the old and new regime affect your income tax computation and how you can easily calculate income tax online.

Income Tax Calculator For Fy 2020 21 Ay 2021 22 Excel Download

No comments